Want to Make Extra Money Now?

|

Minimalism and saving money is so in right now. Owning (and consuming) fewer things is not only great for the environment, but it’s great for your wallet as well.

Every dollar you’re not spending money on clothes you don’t need and things you won’t use is a dollar that can go towards savings, retirement, or really anything else better allocated.

With the recent popularity of books like Marie Kondo’s The Life-Changing Magic of Tidying Up, it seems like everyone and their mother is on a belongings purge.

It’s a fantastic book, but what Kondo fails to mention with her many tips on organization is that the biggest benefit of adopting minimalism and minimalist living is that you automatically adopt a no-spend lifestyle that so many people shoot for.

The hardest part about adopting minimalism is that it can feel a lot like sacrificing.

For some, it’s tough to tell the difference between need, and want. “I need a new watch” vs “I want the latest Apple watch with all the frills”.

Okay, maybe that example seems easy, but there are many other purchasing decisions where the line isn’t quite so clear.

Minimalism and Money Tips

Here are 6 reasons why minimalism can benefit your pocketbook. You'll soon realize that minimalism and saving money go hand in hand:

1. Unsubscribe from mailing lists

Having a clean digital life is just as important as a physical one. Just as a desk can be cleared of loose papers, an inbox can be cleared of emails.

Do you have any daily (or weekly) emails that you just automatically delete?

Take 30 seconds and unsubscribe.

Many companies get sales from enticing newsletter readers with “exclusive” and “limited-time” sales, which are essentially just a drain on money.

You can’t buy what you don’t see.

2. Go through your closet and remove anything that you haven’t worn in over a year

Get rid of items you haven't used in ages. It's that simple, but you can exclude special occasion items like suits, parkas, etc.

You can easily donate these items to your nearest Salvation Army/Goodwill, or see if you can get a couple of bucks for nicer items by selling them online, at a garage sale, or consignment shops near you.

Don’t forget worn-out items. That old tee shirt that got you through your high school years?

You may still love it, but it’s really just a nostalgia thing now. Turn it into a quilt or a rag, or take a picture and put it in the donate pile.

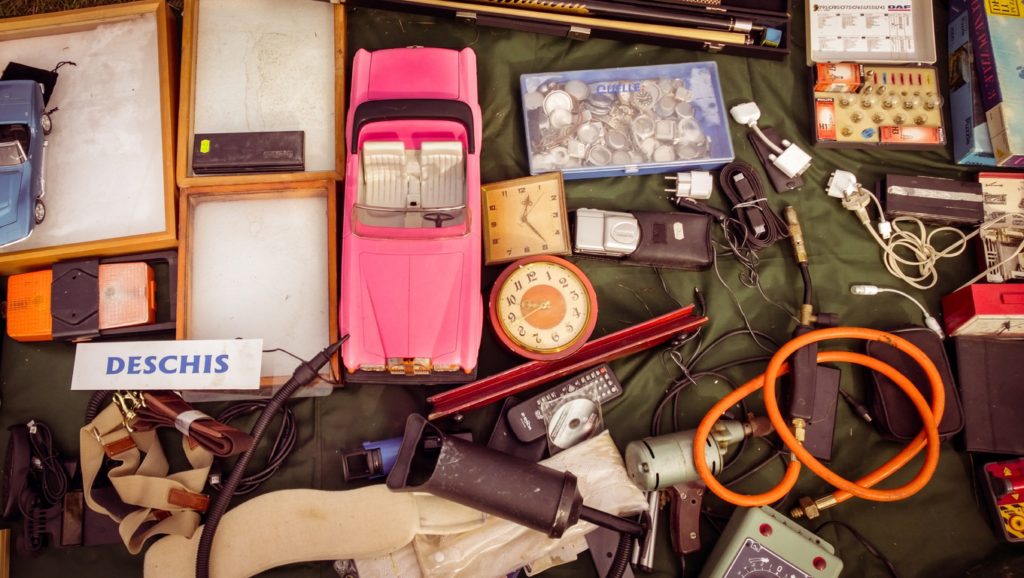

3. Purge your home of broken and unused things

Unless you’re handy with tools, chances are, once something breaks, it stays broken.

Those pants with the broken button that have been sitting around for two months? Get rid of it.

That old router you meant to take apart and figure out what was wrong? Get rid of it.

Those old batteries that may still have some charge left in them? Get rid of them (safely, please).

Those skincare samples or beauty products that you never ended up finishing? Get rid of them.

A big part of minimalism is knowing exactly what you have in your possession. Better to know for sure that you don’t have an item than to spend an hour searching for it only to realize that you had left it at your parents’ house months ago.

Electronics are a really big category here since that become antiquated faster compared to other belongings. If you’re no longer using your first-generation iPad, it’s time to let it go or sell it using selling apps.

Our newsfeeds are a curated list of people that only showcase the best part of their daily lives.

Looking at that high school acquaintance that is backpacking across Europe can cause serious FOMO.

On one hand, if that’s something you want to pursue, great.

On the other hand, if the only reason those experiences appeal to you is so that you can share similar experiences with your friends, then it’s time to rethink your strategy.

5. Get rid of unhealthy food from your pantry

Junk food is not good for the wallet. For a family size bag of chips, you can typically get 2+ pounds of dried rice or beans.

That bag can feed you for weeks, whereas those chips would probably only last the duration of a Sunday afternoon football game.

It’s money that you’re better off not spending, and calories you’re better off not eating.

It’s also minimalistic to boot because you’re reducing the number of foodstuffs in your kitchen (hopefully on a permanent basis).

6. Don’t make any impulse buys.

Within this short list, this tip is absolutely the hardest. There’s this huge desire to fulfill our instant gratification needs, which manifest themselves into impulse buys.

By telling yourself you can have it later, you’ll not only satisfy some of that gratification — 9 times out of 10, but you’ll also forget about the need and the desire will go away completely.

Minimalism and Saving Money

These tips are just a small place to start with minimalism and saving money.

If you’re serious about adopting or at least attempting a minimalistic lifestyle, there are many online resources and bloggers dedicated to it, just a quick Google search away.

Your home will be happy, and your wallet will be happy.

The positive side effect of all this? Some peace of mind.

Find More Ways to Save Money

Best Apps to Help You Save

|

|

|

- Free budgeting tools

- Retirement planner

- Free portfolio advice

- Robo plus human advisors

- Automatically invests spare change

- $20 new user bonus

- Cash back at select retailers

- Get control over your subscriptions

- Stay on top of your spending

- Put your savings on autopilot