Want to Make Extra Money Now?

|

When the weight of a $5,000 credit card debt looms large, breaking free can feel like a monumental task. Yet, with the right strategies and tools at hand, shedding this financial burden becomes not only possible, but methodical. Below are five expert-recommended ways to pay off $5,000 in credit card debt, empowering you to regain control over your finances.

How to Pay Off $5,000 in Credit Card Debt

I paid off $30,000 in debt in just under 12 months. The first thing Iwould suggest creating a personal budget you could do weekly, bi-weekly or monthly.

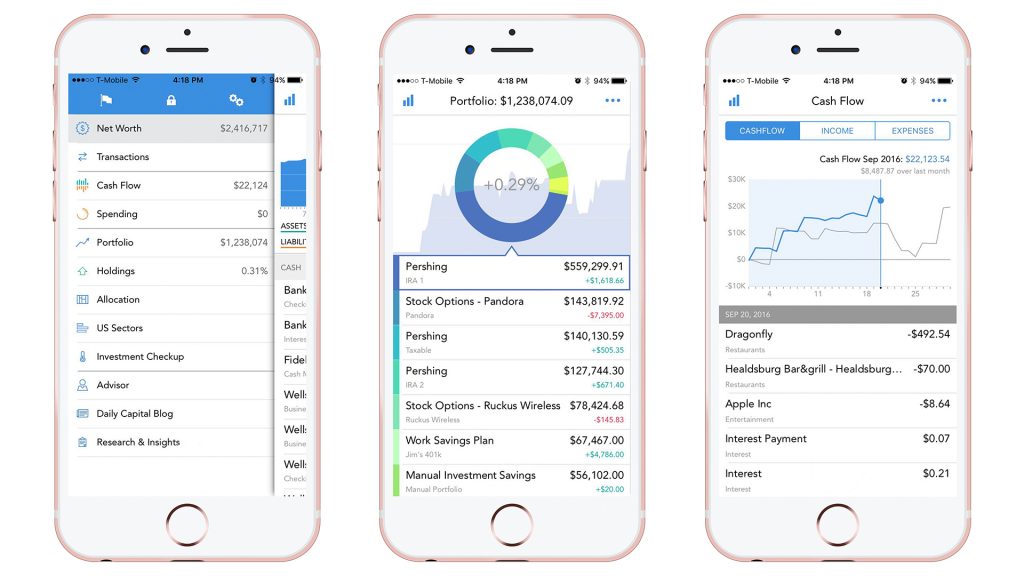

At the moment I am doing monthly having all of my finances in one centralized place from income, expenses, investments, and daily spending (categorized) you will start to see where all your money is going and what to focus on the following month.

I use Empower to track where all of my money is going to the last penny — it's free and works wonders for budgeting.

You can see how much you can contribute (adding more to the minimum) to your student loans/consumer debt every month and you can tweak your contribution until that debt is paid off. It's really useful and you can learn more in this Empower review.

Take control of your finances with Empower's free personal finance tools. Get access to wealth management services and free financial management tools.

But if you need an actual plan of action on how to pay down debt, here you go:

1. Harness the Debt Snowball Method

Begin with the Smallest Debt

Focusing on your smallest credit card debt and paying it off can provide the psychological win necessary to sustain momentum. While you focus on the smallest debt:

- Maintain Minimum Payments: Continue paying the minimum on your other debts to avoid penalties.

- Ramp Up Payments: Dedicate as much money as possible to the smallest debt until it's cleared.

- Roll Over: Once the smallest debt is paid, channel those funds to the next smallest debt.

Benefits

- Immediate Wins: Witnessing debts disappear can boost your motivation.

- Simplified Finances: Fewer balances mean fewer due dates to manage.

2. Unlock the Potential of the Debt Avalanche Method

Focus on Highest Interest First

Unlike the snowball method, the avalanche strategy targets the debt with the highest interest rate:

- Prioritize High-Interest Debt: Allocate additional funds to the debt with the highest interest.

- Stay Committed: As one debt is paid off, reallocate funds to the debt with the next highest rate.

Benefits

- Maximum Savings: By tackling high-interest debts first, you save more in the long run.

- Accelerated Debt Reduction: Less money wasted on interest means more money towards the principal.

3. Explore Debt Consolidation Opportunities

Combine into a Single Payment

Debt consolidation can streamline multiple debts into one manageable monthly payment:

- Seek a Personal Loan: Borrow enough to pay off all credit card balances, then pay off the loan in monthly installments.

- Consider a Balance Transfer Credit Card: Transfer your credit card balances to a card offering a 0% introductory APR. Aim to pay off the balance before the promotional period ends.

Benefits

- Lower Interest: Potentially benefit from a lower interest rate than your individual credit card rates.

- Simplified Management: One monthly payment can be easier to manage than multiple payments.

4. Implement a Strict Budget

Analyze and Cut

Crafting a budget can help you identify non-essential expenses to trim:

- Review Monthly Expenses: List all your monthly costs and classify them.

- Eliminate Non-Essentials: Dining out, premium streaming services, and other non-necessities can be reduced or eliminated.

- Allocate Savings to Debt: Use saved money to pay more towards your credit card debt.

Benefits

- Increased Awareness: Recognize and curtail excessive spending.

- Boosted Debt Payments: Allocate more funds to clear debts faster.

5. Leverage Modern Debt-Reduction Apps

Technological Assistance

Several apps can automate savings or round up purchases, directing the extra cents towards your debt:

- Qoins: Rounds up your transactions and uses the spare change to pay off debt.

- Tally: Helps manage credit card balances and automates payments to save on interest.

- Digit: Analyzes your spending to find extra money and applies it to your debts.

Benefits

- Automated Savings: Effortlessly contributes to debt reduction.

- Enhanced Debt Management: Uses algorithms to optimize payment strategies.

Six-Step Plan to Crush Debt

Here's a six-step plan to crush that debt over the next 12 months:

- Free your credit use

- Create a safety net

- Develop a plan

- Contract your creditor

- Execute the plan

- Make the mosts of windfalls

Step 1: Freeze your credit use

While you don't need to cut up your credit cards, it may help if you take them out of your wallet or purse so you won't use them. If you only have debit cards then you can't spend what you don't have since they are linked to money in your checking account and not a line of credit. This is important when you are focusing on paying off consumer debt.

Step 2: Create a safety net

You will definitely need an emergency fund which you can stash in a savings account. Stashing three to six months of expenses is the norm, so when you run into an emergency you can use your emergency fund instead of getting more into debt.

Step 3: Develop a plan

Making the minimum monthly payments is not a plan. You'll either need to save more by cutting expenses or earn more — ideally both. You can trim on your expenses by using money-saving apps which go through your financial accounts and find savings for you.

Apps can really improve you financial standing — and there are even money-making apps that can help you earn money from your phone. In addition, you can take another job, work as a freelancer, or selling things in order to work smarter, not harder.

Step 4: Contact your creditor

You can see if consolidating your debt is good idea for your situation. Debt consolidation might work for you if you want to work towards becoming debt-free by reducing your monthly interest rate and payments to something more manageable for you.

Step 5: Execute the plan

If you have only one card with debt on it then it's simple, use all your extra cash towards paying this credit card off. If you have multiple cards, then pay the card with the highest interest rate first, and pay the minimum balance on the other cards. Once the card with the highest interest rate is paid off, move on to the next card with the highest interest rate to focus on paying off.

Step 6: Make the most of windfalls

Got a bonus at work? Tax refund? All of your cash windfalls should go towards paying off your credit card debt.

FAQs on Paying Off $5,000 in Credit Card Debt

1. Which method is more effective: Debt Snowball or Debt Avalanche?

Both methods have their merits. The Debt Snowball method provides psychological wins as you quickly pay off smaller debts, which can be motivating. The Debt Avalanche method focuses on paying off high-interest debts first, saving more money in the long run. The best method depends on individual preferences and which approach will help maintain consistent payments.

2. How do Debt-Reduction Apps work?

Debt-reduction apps, such as Qoins, Tally, and Digit, use algorithms to analyze your spending habits. They might round up your purchases, taking the extra cents and applying them towards your debt, or they might automate payments in a way that saves you on interest.

3. Are there any hidden fees with Balance Transfer Credit Cards?

While many balance transfer cards offer a 0% introductory APR, they may also come with transfer fees, which are typically a percentage of the transferred amount. It's essential to read the fine print and understand any fees or charges.

4. How long should my budget plan be when aiming to pay off $5,000 in debt?

The duration depends on your monthly income, expenses, and how aggressively you want to tackle the debt. Some people might aim for a 12-month plan, while others could opt for 24 months or longer. Using budgeting tools or consulting with a financial advisor can help tailor a plan to your situation.

5. Will consolidating my debts affect my credit score?

Debt consolidation can have mixed effects on your credit score. Initially, applying for a new loan or credit card (for balance transfers) may cause a slight dip due to the credit inquiry. However, if you consistently make payments on the consolidated loan or card and reduce your overall debt, it could positively impact your credit score over time.

6. Is it possible to negotiate interest rates with credit card companies?

Yes, it's sometimes possible to negotiate a lower interest rate with your credit card issuer, especially if you've been a long-time customer and have a history of timely payments. It never hurts to call and ask for a reduced rate.

7. What if I can't keep up with my debt payments despite these strategies?

If you find yourself unable to manage your debt even with these strategies, it might be time to consult with a credit counselor. They can offer guidance tailored to your specific situation and may recommend solutions like a debt management plan.

Conclusion

Breaking free from a $5,000 credit card debt may seem challenging, but armed with the right strategies, the journey can be smoother than anticipated. By leveraging proven methods, consolidating debts, creating strict budgets, and utilizing modern technology, you can pave your way to a debt-free life. Remember, the key lies not just in choosing the right strategy, but in consistent execution and commitment to your financial well-being.