Want to Make Extra Money Now?

|

Are you wondering about how to get started with penny stocks?

If so, you're in for a treat. Today, I'll share with you some more information about penny stocks & how to get started.

If you turn to any investment news channel you’ll frequently see journalists talking about a stock few companies. There are the Apples, the Google’s and of late, the Teslas of the trading and investing world.

You hardly ever hear them talk about penny stocks. Penny stocks, it seems, are the black sheep of the trading and investing community; they are the errant uncle you dare not invite to Thanksgiving dinner; the son who drops out of medical school to pursue some mystical adventure in the Himalayas.

This leads to the obvious question: what are penny stocks? And why are they not discussed in the mainstream, as much? The short answer is the subject of this piece. Stick with it and you’ll see why penny stocks are the ultimate equalizer among investors and traders, and why making them central to any trading or investing strategy is not only sound but potentially lucrative.

What Are Penny Stocks?

In order to have a discussion about anything, you need a vocabulary; a way of defining and setting the limits of the discussion. In this regard, we can use the mainstream definition of penny stocks which is any security that trades on the stock market and which does so at a valuation equal or up to $5.

So, $5 sets the limit, and it’s important too as you see. This threshold is the only one that creates the definitional standard for classification. This means, of course, that penny stocks come in all shapes and sizes subject to this rule. You can buy penny stocks by using investing apps or through brokerages. There are penny stocks in the pharmaceutical industry, the finance industry, healthcare, education, technology, oil, and gas; even space exploration has its fair share of companies that trade below $5.

Penny Stocks Offer Access

This $5 threshold is beneficial to the beginner day trader for one important reason: access. Let’s face it, many beginners don’t start out with windfall capital – few have more than say $10,000 in the bank with which to engage the markets. And even if the average day trader with $15,000 cash were to try and play the stock market at the higher, more mainstream levels, they probably wouldn’t get very far.

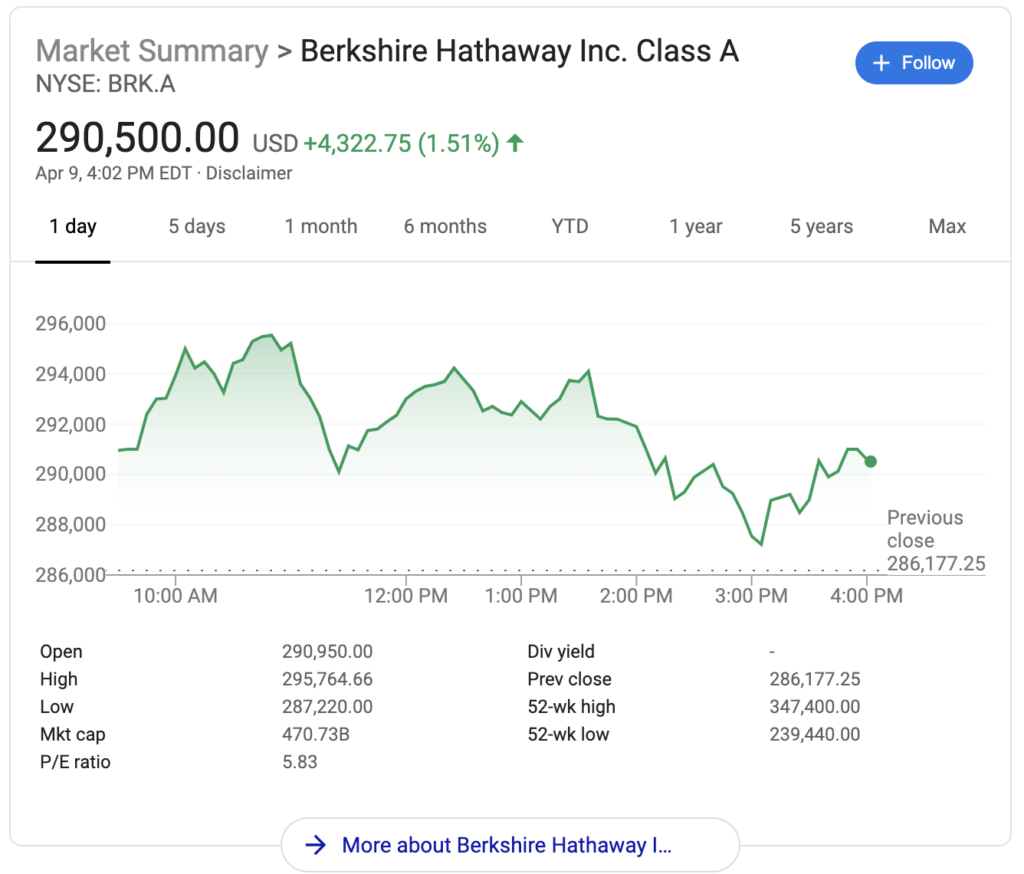

If a trader were to get ambitious and say look at acquiring shares in Warren Buffett’s company, they’d have to fork out around $290,500 for a single share. Two shares are essentially half a million dollars.

It doesn’t take much to work out those mainstream companies that don’t count as penny stocks are beyond the reach of the ordinary investor – they certainly are that way for the vast majority of day traders and this is why penny stocks are so important.

Why do people enjoy trading penny stocks? The inherent pricing structure for penny stocks means that day traders can stretch his or her capital further. If a stock is $5, then $500 will provide a trader with 100 shares; if that same stock is trading for $0.50, then that same $500 will provide a trader with 1000 shares; and if a stock is trading for $0.05, then that $500 will provide a trader with 10,000 shares. There’s a regressive beauty to penny stocks that people in the mainstream don’t like to talk about – it’s quite obvious just looking at those numbers just illustrated.

Of course, day trading penny stocks is all about profits, and the common argument against penny stocks is that they are risky. What trading or investing instrument isn’t?

Right now as this piece is written, some investor in a blue-chip stock somewhere has is picking up the pieces because the stock they promised would be timeless in value has tanked.

Investors in Kodak understand this painful truth: all stocks are risky. Penny stocks are no different from most investments; the money you put in them can multiply in value, or it can decrease in value based on the movement of the penny stock.

By any objective measure, then, the question “what are penny stocks?” can best be answered by stating the reality that they are no better instruments for day traders to access the profitable world of day trading or indeed, investing.

A great source of information on buying penny stocks are the various penny stock newsletter services that provide key updates and trading alerts on these small companies. Investment newsletter services can deliver penny stock alerts to traders and provide market news updates through blog posts reporting news on OTC stocks, SMS texts, and newsletter emails.

Best Penny Stocks to Buy Now

Every day people, from average investing Joe's to professional traders and hedge funds are looking for that next great penny stock investment.

It could be one you've already heard of or a company trading on the pink sheets with no volume or one that you saw on a stock alert service. There is a limitless amount of opportunities out there in “the market.”

However, not all choices are created equal. Some penny stocks are better than others for a number of reasons.

There are thousands upon thousands of companies out there in the markets right now, many with stock prices trading below $2.00 per share that has huge potential to shoot up like crazy overnight.

It's important to remember what you're investing into though and think long term over short term.

ContextLogic Inc. (NASDAQ:WISH)

You may have heard of Wish, an e-commerce company that has become a major player in the online shopping world. The website is known for its cheap prices and long shipping times with occasional customer service issues.

The stock has been beaten over the past few months after it's IPO price of $24 a share.

Wish dives toward a record low as analyst downgrades after disappointing earnings report.

ContextLogic has a newly created support level at $6.71. On Monday the stock tested this level and it held, which was reaffirmed on Tuesday when the stock also bounced upwards from that same test.

I expect them to roll out new features and once they fix some internal developments, the stock should head back to the 20s in the long term. If you have $500 lying around, I'd say Wish is a safe bet under $10.

Alexco Resource Corp. (NYSE: AXU)

A publication named “The Silver Institute” predicts the price of silver to increase from about $27 to $32 by the end of this year, according to Reuters.

Given that the organization in question is made up of various silver companies, I have to take this estimate with a grain of salt.

Should the economy open again and demand by industry increase, Alexco Resource stocks could reach upside of 70%.

A forward P/E ratio of 6.90 would seem to confirm my bullish expectations.

Inpixon (NASDAQ: INPX)

Inpixon (INPX) is a penny stock that is desperately trying to turn its fortunes around. This company has been able to generate some capital and should be successful if it continues down this path.

Basically, Inpixon develops software to make public spaces and facilities more efficient, ranging anywhere from making schools safer for children to facilitating wireless internet access in malls to cut down on crime.

But Inpixon has seen much better days. The company's annual revenue has grown 68% and 48%, respectively, in the last two years. And its sales numbers have been up 137% and 51%, respectively, in the most recent quarters. For the quarter before that, it saw a 23% drop–not too bad given COVID-issues.

The excellent P/B ratio is 0.70 and the P/C ratio is at 1.21, while surprisingly strong balance sheet with a quick ratio of 8.60 and low debt/equity ratio of 0.04, meanwhile this year's EPS are set to be 97.9%, with gross margin at 71%.

Over the past two months, Inpixon has announced three major contract wins with a “global social media company,” a “multinational mass media and entertainment conglomerate” and an “international banking organization.”

This trend implies that Inpixon is gaining momentum and the company may be worth the investment now before any more deals are announced.

Gold Resource (AMEX: GORO)

Gold Resource Corp is a mining company with mining operations in Oaxaca, Mexico and North Carolina, USA.

The project targets inexpensive projects with a high return on investment.

The Company offers its shareholders the option to convert their cash, or paper, dividends into physical gold and silver and take delivery.

Greenpro Capital (NASDAQ: GRNQ)

Greenpro Capital Corp operates and provides business solution services to small-medium size businesses located in various locations at the South East, East Asia, Thailand and Taiwan.

It provides cross-border business solutions, record management services and accounting outsourcing services.

Among other services it offers, its cross-border business includes tax planning, trust and wealth management, cross border listing advisory services and transaction services. Along with these services is its venture capital business.

Its segments include Service business engaged in provision of corporate advisory and business solution service; and Real estate business engaged in trading or leasing of commercial real estate properties in Hong Kong and Malaysia.

I'll keep this list updated, so be sure to favorite this post to see my favorite penny stock picks.

Get a Free Penny Stock with Robinhood

If you want to buy any of the penny stocks above or do your own research, you can get started with Robinhood. You can read my experience day trading on the free trading app here.

Or you can go ahead and claim a free stock just for being a new investor.

Robinhood has commission-free investing for stocks, options, ETFs, crypto, and tools to help shape your financial future. Sign up and get your first stock worth between $5 and $200, free.

Yup, it’s true! There are several companies out there that will give you free money to invest in stocks. My favorite offer currently is:

Robinhood: This is a free investing app for your phone. I really mean free all around – free to join and they don’t charge any commission fees to buy or sell stock. You can get a share of stock like Apple, Ford, or Sprint for free when you join through this link.

The value of the free share may be anywhere between $2.50 and $225 and fluctuates based on market movements. Sign up through here.